One platform. Full compliance. AI-powered precision.

A.ID is a comprehensive solution designed to address complex compliance use cases. We empower fintechs and regulated businesses to mitigate risks associated with high-risk customer segments while maintaining operational efficiency and trust.

WE ARE TRUSTED BY

We partner with industry leaders in compliance, identity verification, and transaction monitoring to deliver seamless, secure, and innovative solutions for modern businesses

Our Features

Data Flow and Status Model

Seamlessly connect every stage of your compliance journey — from data collection to dynamic risk assessment.

A.ID is designed as an end-to-end infrastructure that transforms fragmented onboarding and verification flows into one continuous, intelligent system.

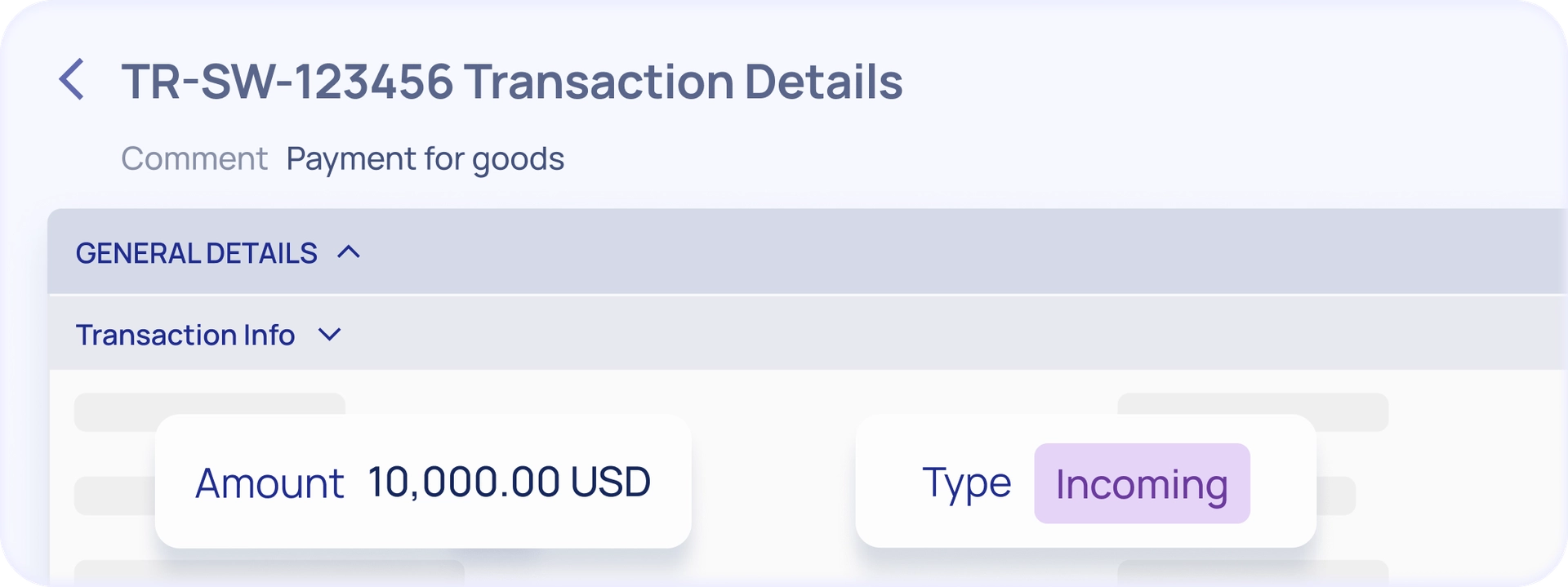

Transaction Monitoring

Monitor, analyze, and act on financial activity — in real time.

A.ID’s transaction monitoring module empowers your compliance team with a fully integrated, rule-driven system that detects risk before it becomes exposure.

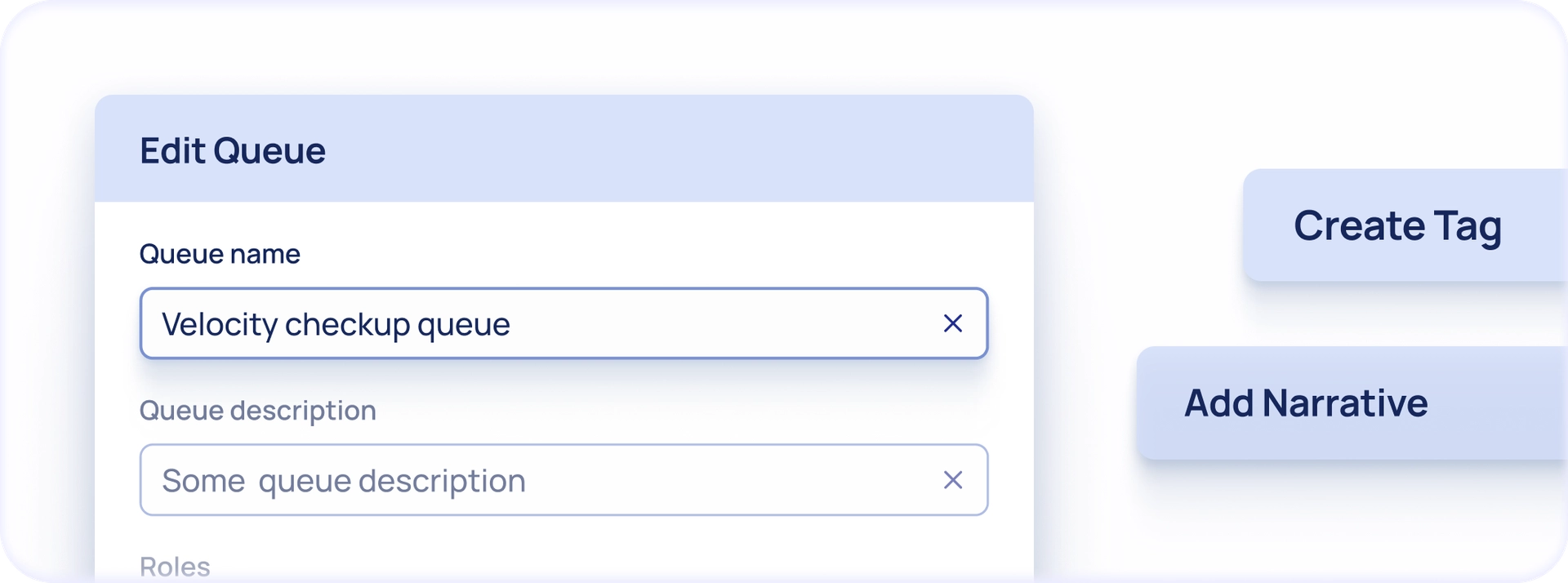

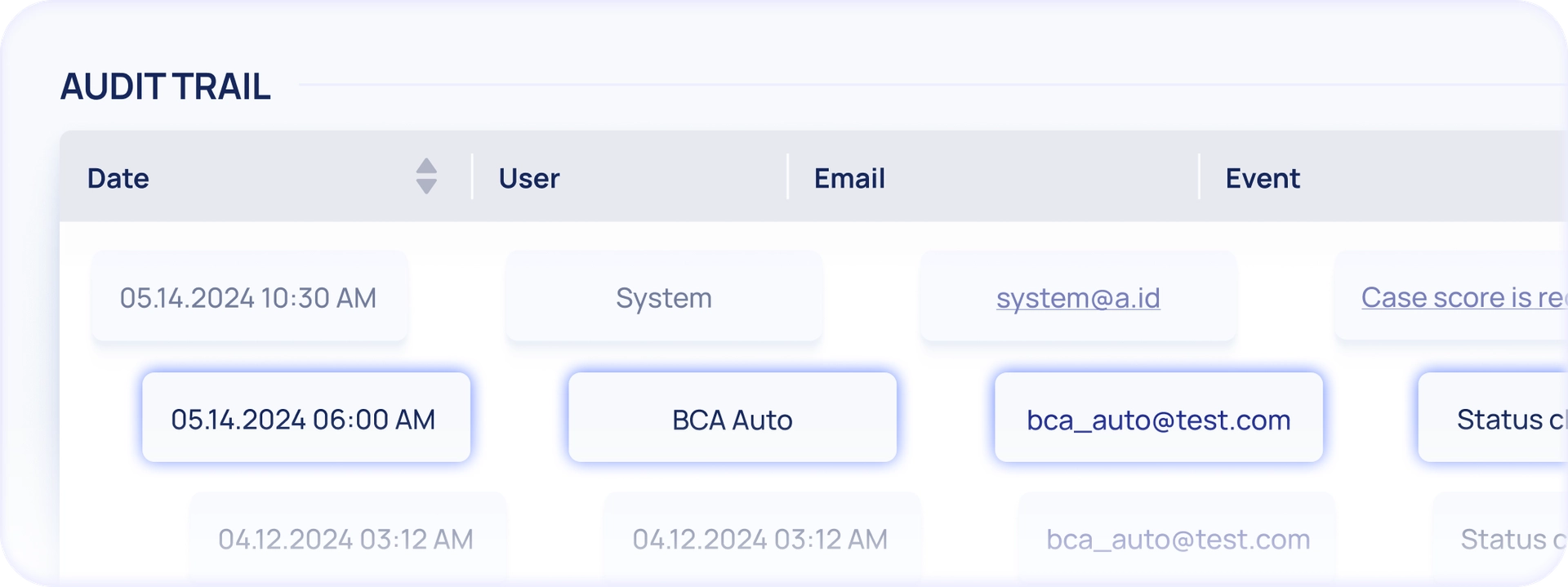

Compliance Toolset

Everything your compliance team needs — in one powerful system.

From day-to-day reviews to high-risk investigations, A.ID brings together the full suite of tools to manage client risk, ensure regulatory alignment, and automate manual overhead.

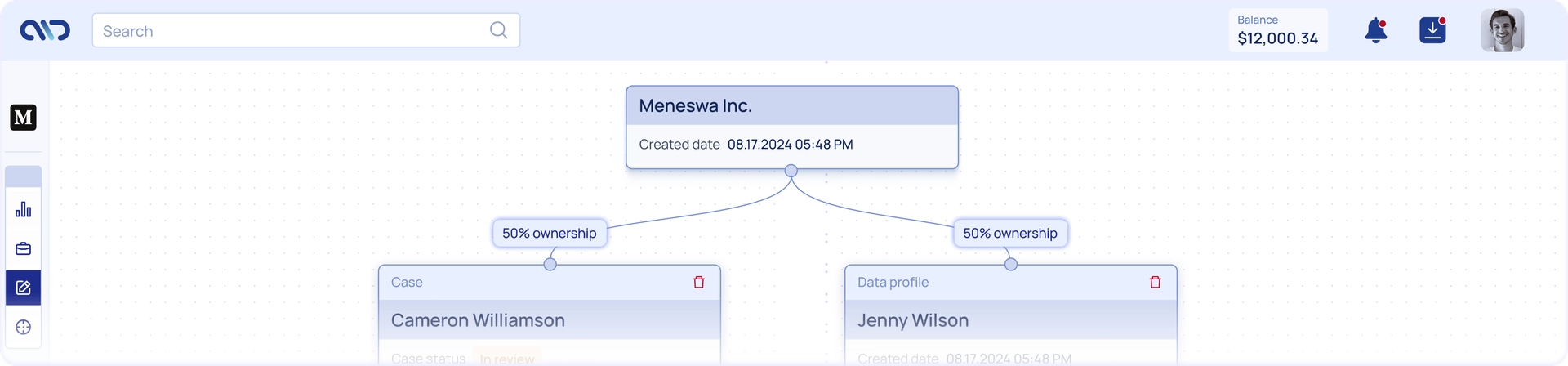

Data Structuring and Data Management

In compliance, data is more than just information — it's your strategic foundation.

A.ID is built to centralize, structure, and activate client data across your entire compliance lifecycle.

Data Security

Compliance starts with trust — and trust starts with security.

At A.ID, data protection isn’t a feature. It’s the foundation.We’re committed to enterprise-grade safeguards, transparent processes, and infrastructure that scales securely with your operations.

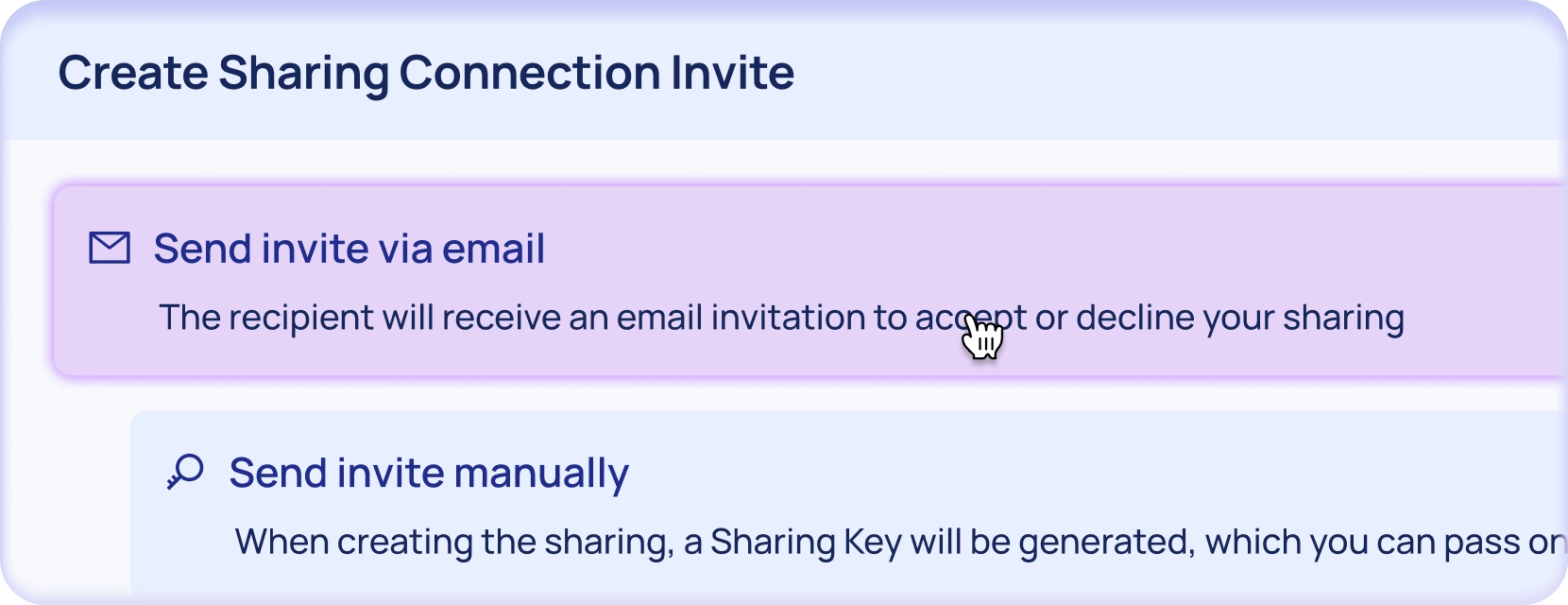

Data Sourcing Proxy

Share, structure, and distribute client data — securely and on your terms.

A.ID’s Data Sourcing Proxy is built to power embedded compliance across partner ecosystems, client-facing portals, and custom business workflows. Whether you’re collecting, verifying, or exposing compliance data — we give you the infrastructure to do it seamlessly.

AI-Powered Compliance

Compliance work is no longer manual.

A.ID embeds AI into every step of your process — giving you faster insights, clearer documentation, and smarter decision-making without the overhead.

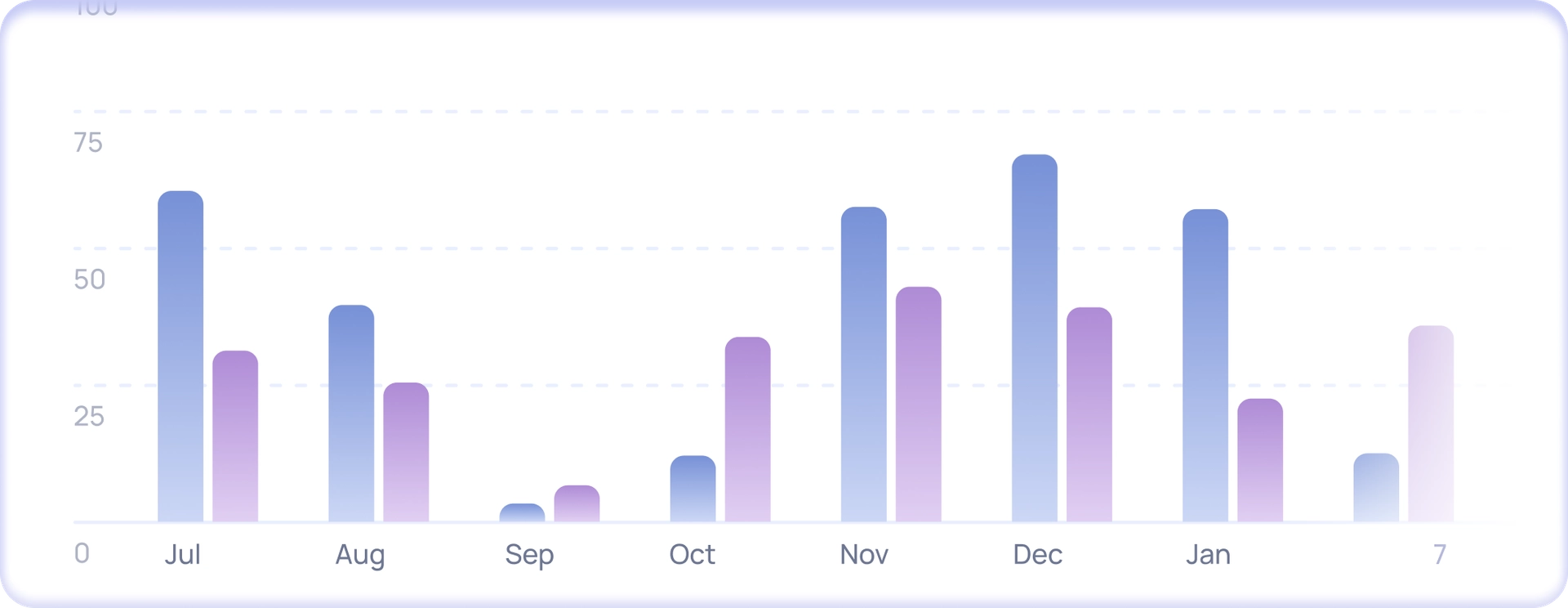

Reporting & Dashboards

Make your compliance visible, measurable, and exportable.

A.ID gives you real-time dashboards, structured data exports, and customizable reports — so you always know what’s happening and can prove it when needed.

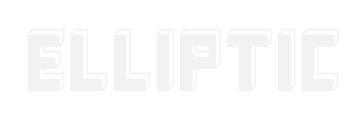

The ideal Know-Your-Customer experience with a single integration

KYC and KYB requirements are unique to each business. With A.ID Compliance as a Service you can fully customize these processes — optimizing identity checks, data validation, and collecting the required documents needed to keep your business compliant and secure — all while fighting fraud.

All just a single integration away!

Specifically tailored for

Business

Regulators

Document Upload & Registry Checks

- Corporate docs, registration certificates, shareholder structure

- External registry lookups via connected providers (manual trigger or preconfigured)

Onboarding Form Submission

- Company fills out custom KYB form (via white-labeled interface or internal input)

- Fields adapt to entity type and jurisdiction

UBO Identification & Ownership Mapping

- UBOs linked to business profile

- Risk-based logic applied to structure complexity and jurisdiction

Sanctions & Adverse Media Screening

- Entity and UBOs screened across external lists

- Internal blacklist checks (if configured)

Profile & Risk Score Generation

- Business profile is created and structured in the system

- Dynamic risk scoring is applied based on all verification data

Case Creation (Manual or Rule-based)

- Analyst reviews profile, confirms documentation, or triggers EDD

- RFI sent if clarification is needed

Ongoing Monitoring & Periodic Review

- Registry updates monitored manually or via alerts

- Periodic review scheduled automatically based on profile type

Transaction Monitoring

- Business-related financial activity is monitored in real time

- Risk events escalate into linked case files

Start using today

Start instantly

Easy API integration available for complex applications

Just paste a link

Start from simply pasting a shortlink to your own applications

Flexible branding

Extensive whitelabel options to match your brand

Easy API

Easy API integration available for complex applications

A.ID Europe UAB | Savanoriu avenue 6, Vilnius, LT-03116, Lithuania

© 2026 A.ID Europe UAB. All rights reserved