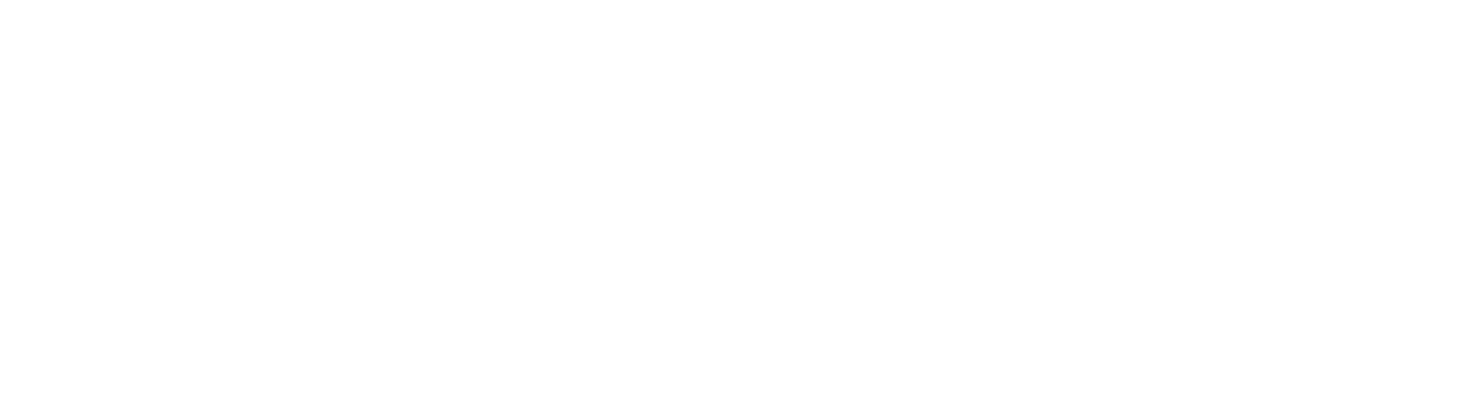

Customise your onboarding flows

- Create a custom onboarding flow for your

customers, no matter who they are - Make changes in real time, no IT support needed

- Choose from countless built-in screenings to best

suit your compliance approach - Customise the appearance to make it feel native

to your application

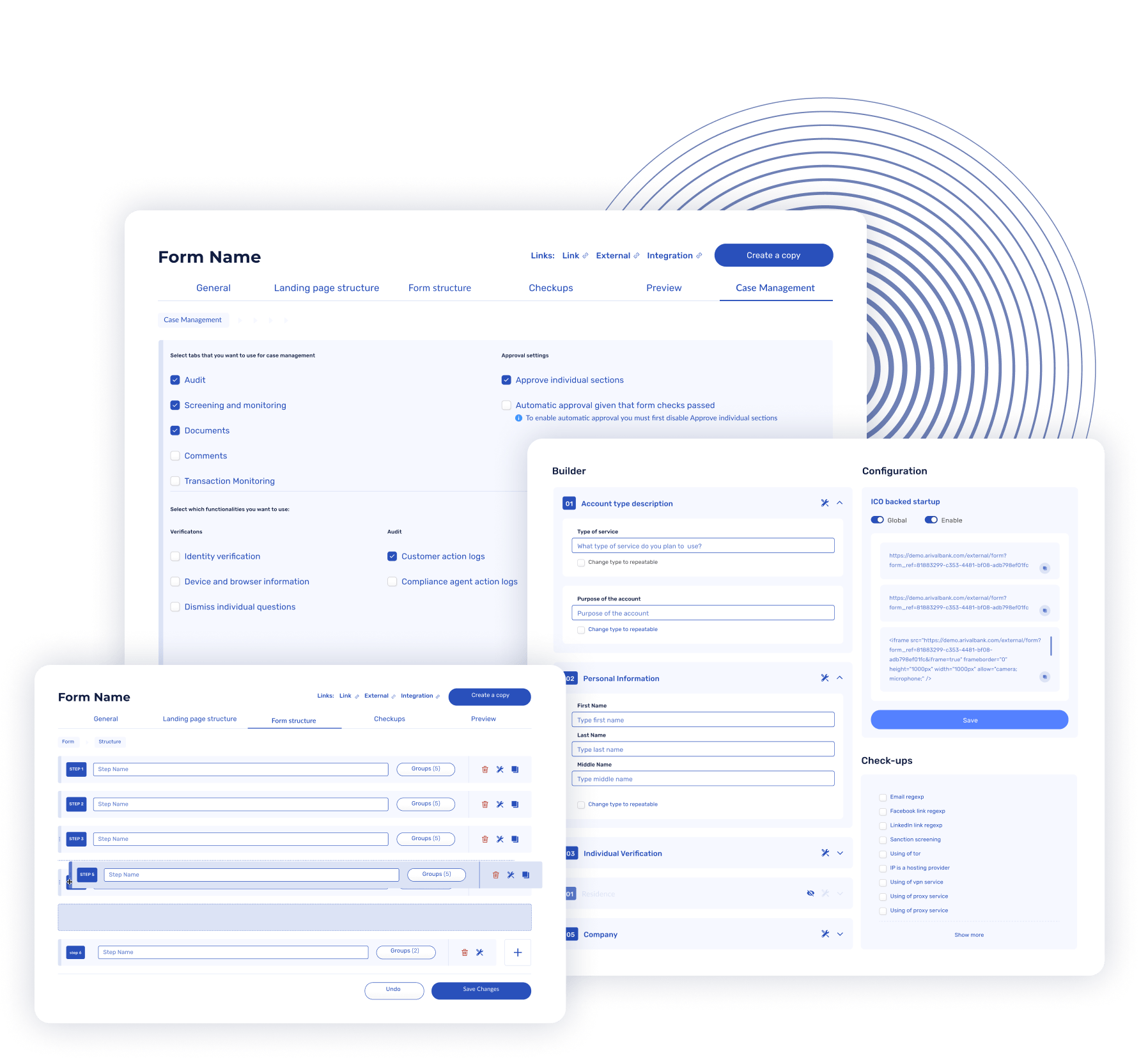

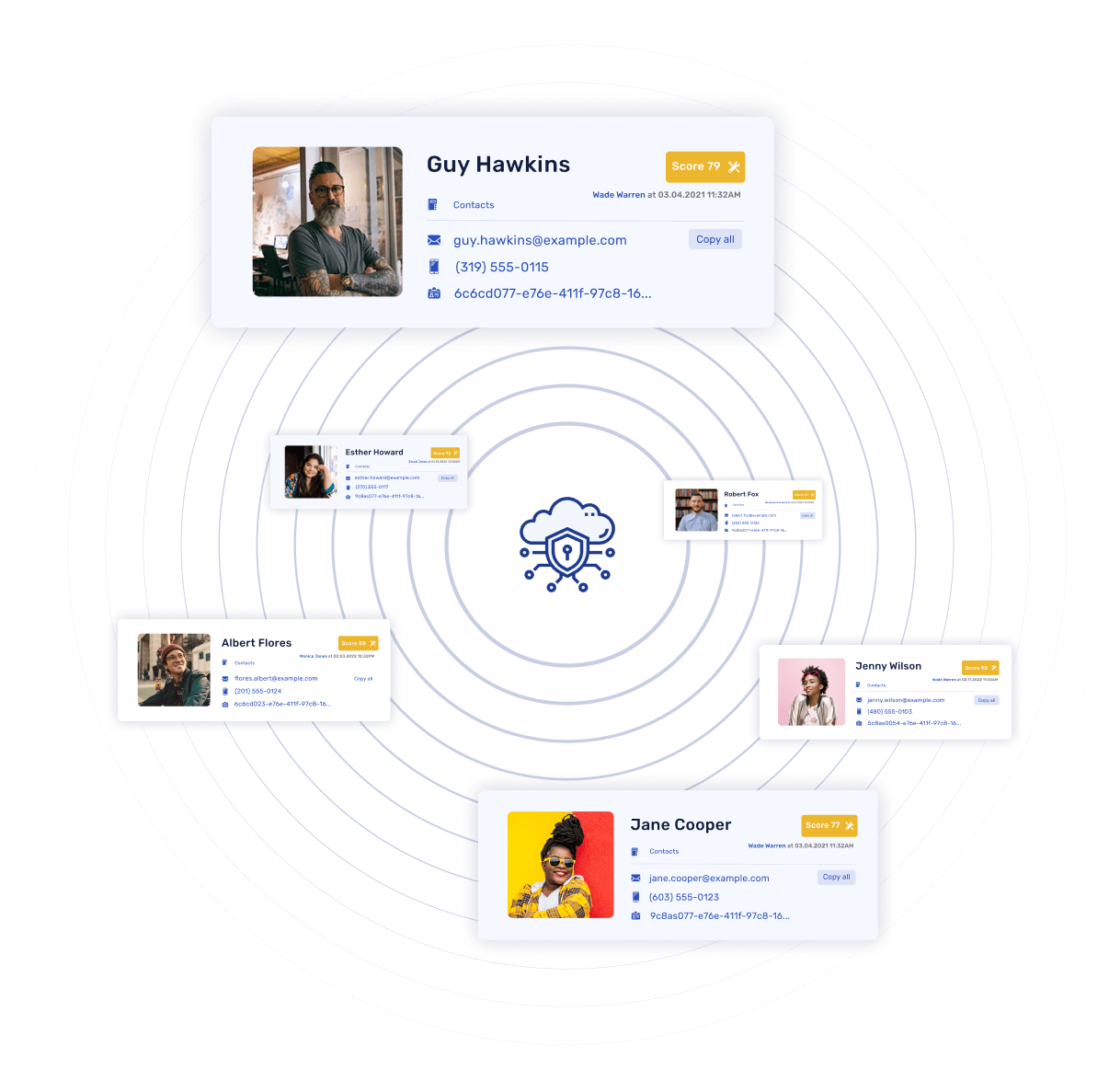

Unified approach to the customer

- A.ID’s systemic approach to customer data allows you

to connect all the dots regarding who your customer is - Each data point related to the customer

is connected

together in a single profile, no matter how complex

the customer structure is - Easily see and understand the connections between various group entities, owners,

directors and

controlling individuals - Make truly informed decisions

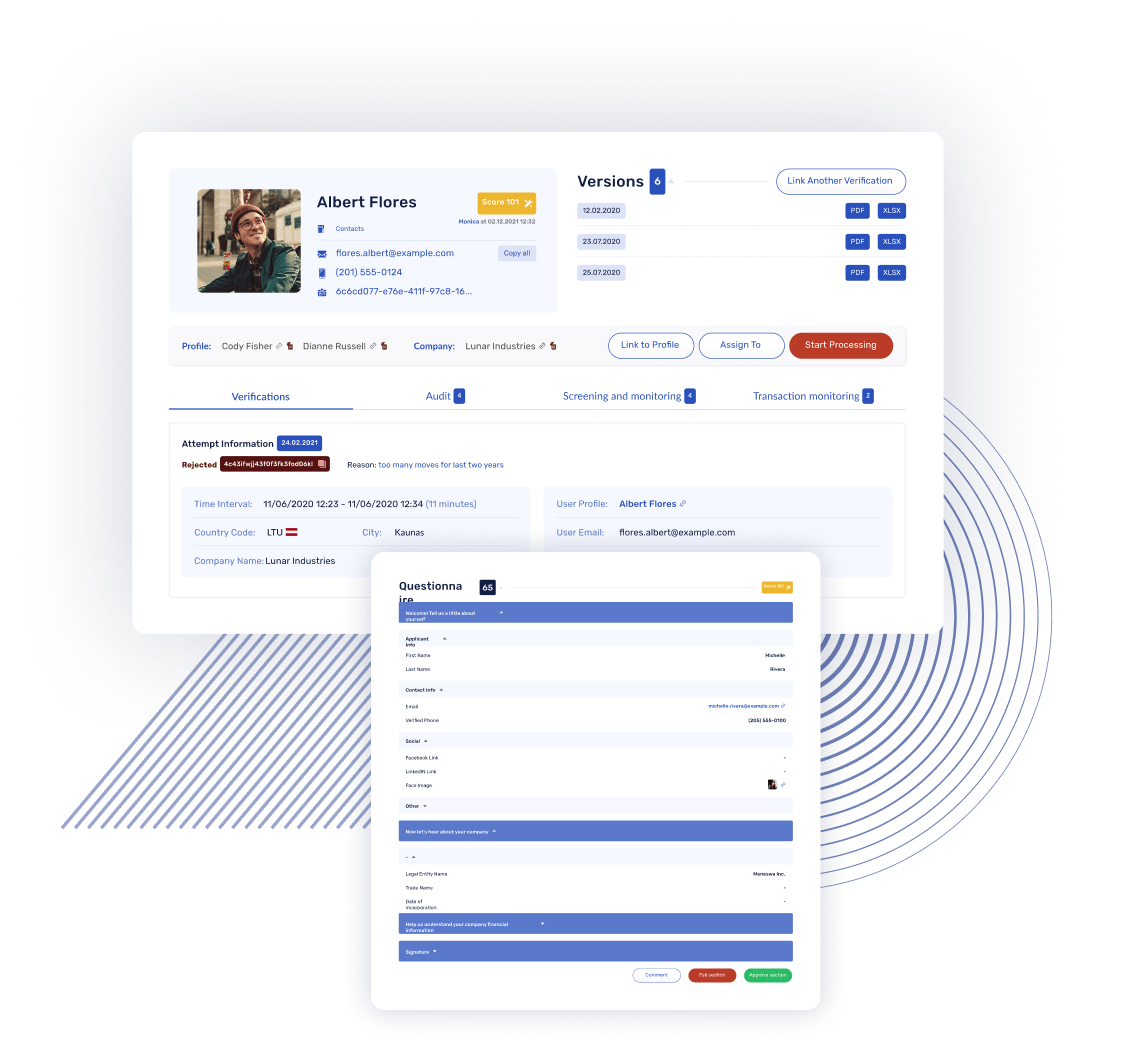

Anti-money laundering screening toolset

A.ID offers a wide range of AML screenings

to ensure our clients

are compliant no matter

the regulatory jurisdiction:

- AML screenings cover various sanction lists, PEP lists and adverse media search

- Ongoing AML screening allows you to screen your end-users in predefined internals

- Access to global company registries

- Crypto-currency wallet screening toolset

KNOW YOUR CUSTOMER’S CUSTOMER

A.ID ensures transparency between entities subject to KYCC requirements

and their banking partners.

- KYCC is a derivative of the standard KYC process, which was necessitated from the growing risk of fraud originating from fraudulent individuals or companies that might otherwise be hiding in second-tier business relationships. i.e. (a customer's customer).

- A.ID has created a transparent KYCC process to authenticate and share corporate client information before any transaction is executed.

- Compliance agents can share or hide the selected customer case making sure that only the needed information is visible to their banking partners.

- Shared information is hosted in a decentralized way and not in some shared database, ensuring the highest privacy and security of the end-user data.

START USING TODAY

- No integration required

to start using our services - Start from simply pasting a shortlink to your own application

- Extensive whitelabel options

- Easy API integration available for complex applications

No integration required to start using our services

Start from simply pasting a shortlink to your own application

Extensive whitelabel options

Easy API integration available for complex applications